The DSAG Investment Report 2024 examines the latest developments and trends in IT and SAP investments in detail. Against the backdrop of a dynamic market characterized by digital transformation and the need for innovation, companies in the DACH region are facing decisive decisions. Here is a summary of the report:

Higher expenses for IT and SAP

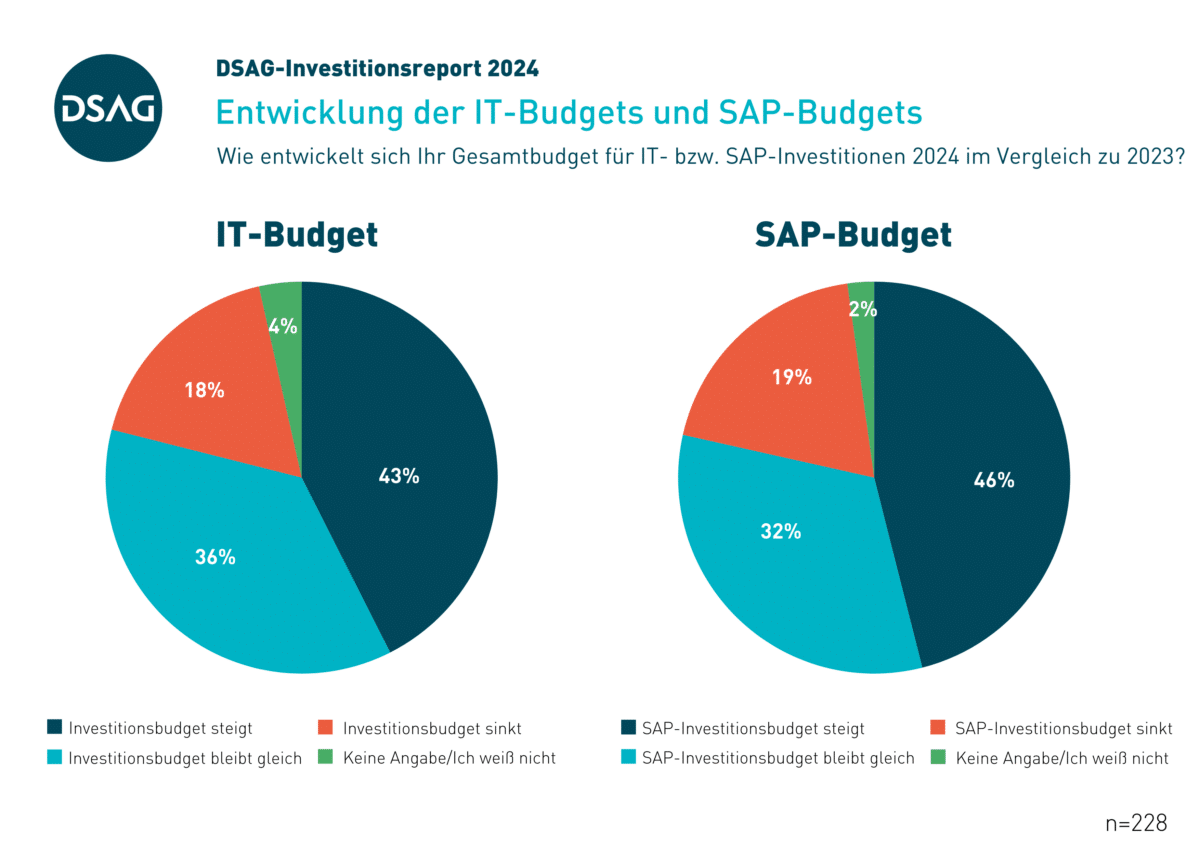

In terms of investments in SAP, 46% of the companies surveyed saw their budget increase (2023: 52%), 32% saw it remain unchanged (2023: 31%) and 19% saw it decrease (2023: 15%).

End of SAP ECC necessitates investments

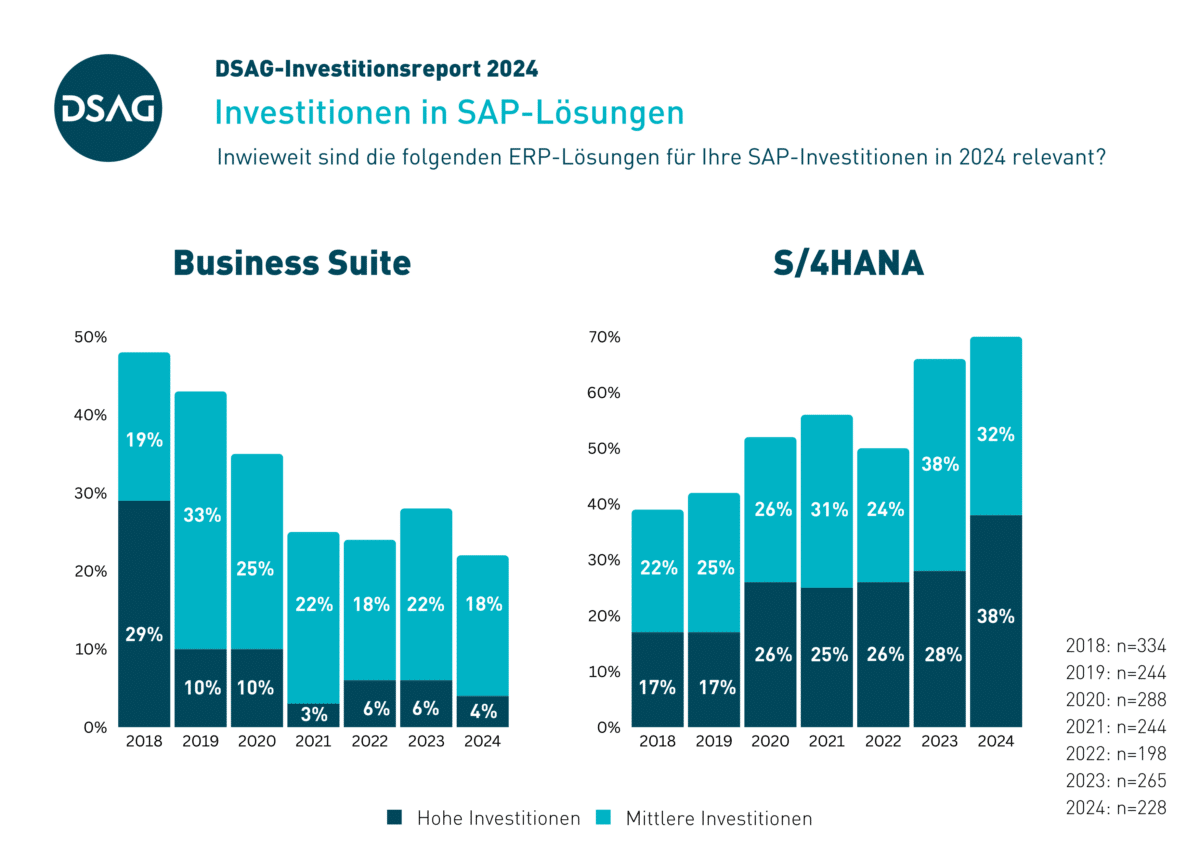

With the end of maintenance for SAP ECC approaching in 2027, it is not surprising that the willingness to invest in SAP S/4HANA in particular is bucking the general trend. 38% of companies consider high investments in SAP S/4HANA to be relevant. This is 10% more than in the previous year. One explanation for this is certainly the market penetration of S/4HANA, which is still below expectations.

When asked which SAP ERP solution they use, 68% of companies answered SAP ECC. SAP S/4HANA on-premise is in second place with 44%, followed by SAP S/4HANA Private Cloud (11%). The use of SAP S/4HANA Public Cloud has doubled within a year, and the cloud ERP is now used by 6% of DSAG members. The cloud operating models for SAP S/4HANA continue to play a subordinate role, with investments already made and security concerns for critical IT infrastructures playing a role here.

S/4HANA Cloud Strategy: Migration with RISE with SAP

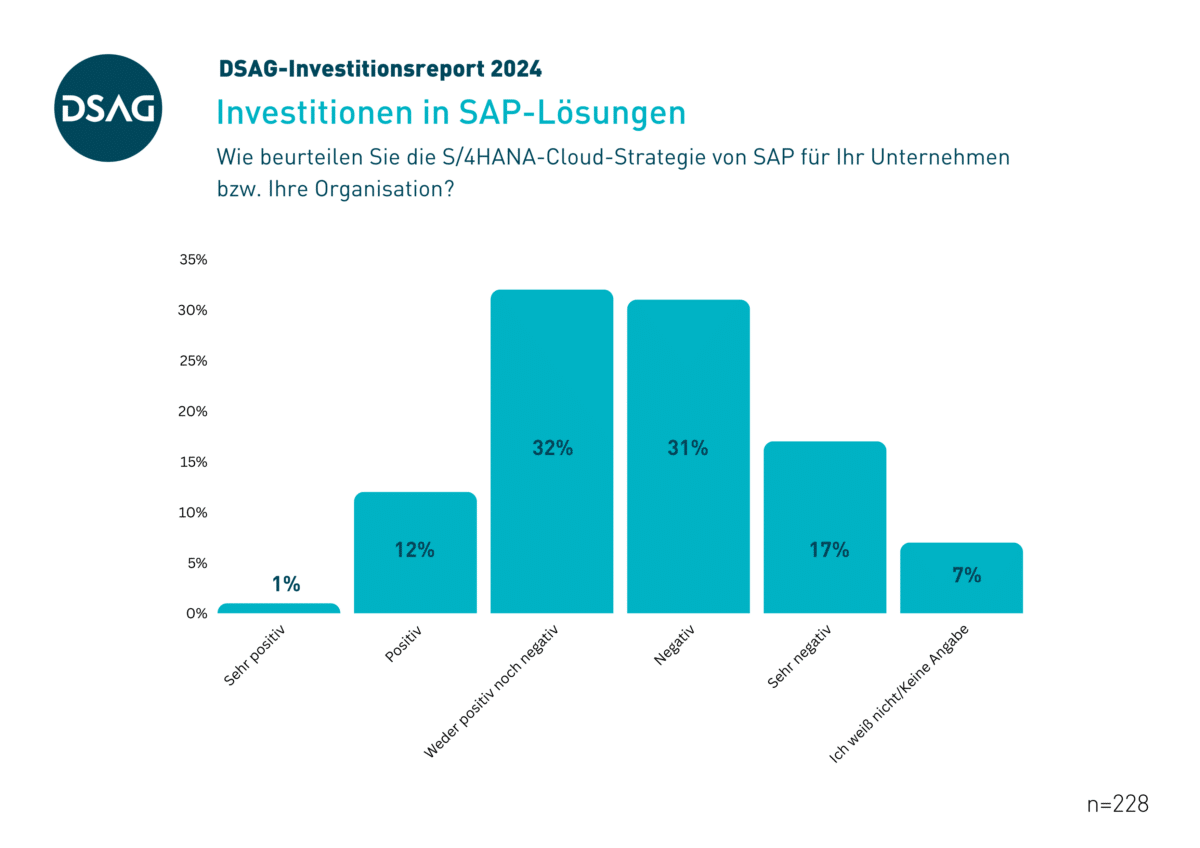

With the help of the RISE with SAP transformation offering, companies can take a holistic approach to the switch to SAP S/4HANA. 16% already use the offering or plan to do so in the future. For 61% of respondents, RISE with SAP is not an option. The DSAG survey took place before the launch of “RISE with SAP Modernization and Migration” .

Only 13% of respondents had a positive opinion of the cloud offerings, while just under half had a negative opinion.

High relevance of SAP BTP for investments

As a scalable cloud platform, the SAP Business Technology Platform (BTP) is playing an increasingly important role in companies’ complex system landscapes. As a result, SAP BTP ranks first when it comes to investments in SAP’s cloud solutions. A third of respondents are planning high to medium investments here. This is followed by SAP SuccessFactors (21%) and SAP CX (12%) as further cloud solutions.

Assessment of the AI strategy

As part of the DSAG Investment Report 2024, the relevance of artificial intelligence (AI) for companies’ IT investments was also surveyed. 28% consider AI to be of high to medium relevance for their IT investments.

Respondents see the benefits of AI primarily in the areas of IT, finance, service, procurement, sales and marketing.

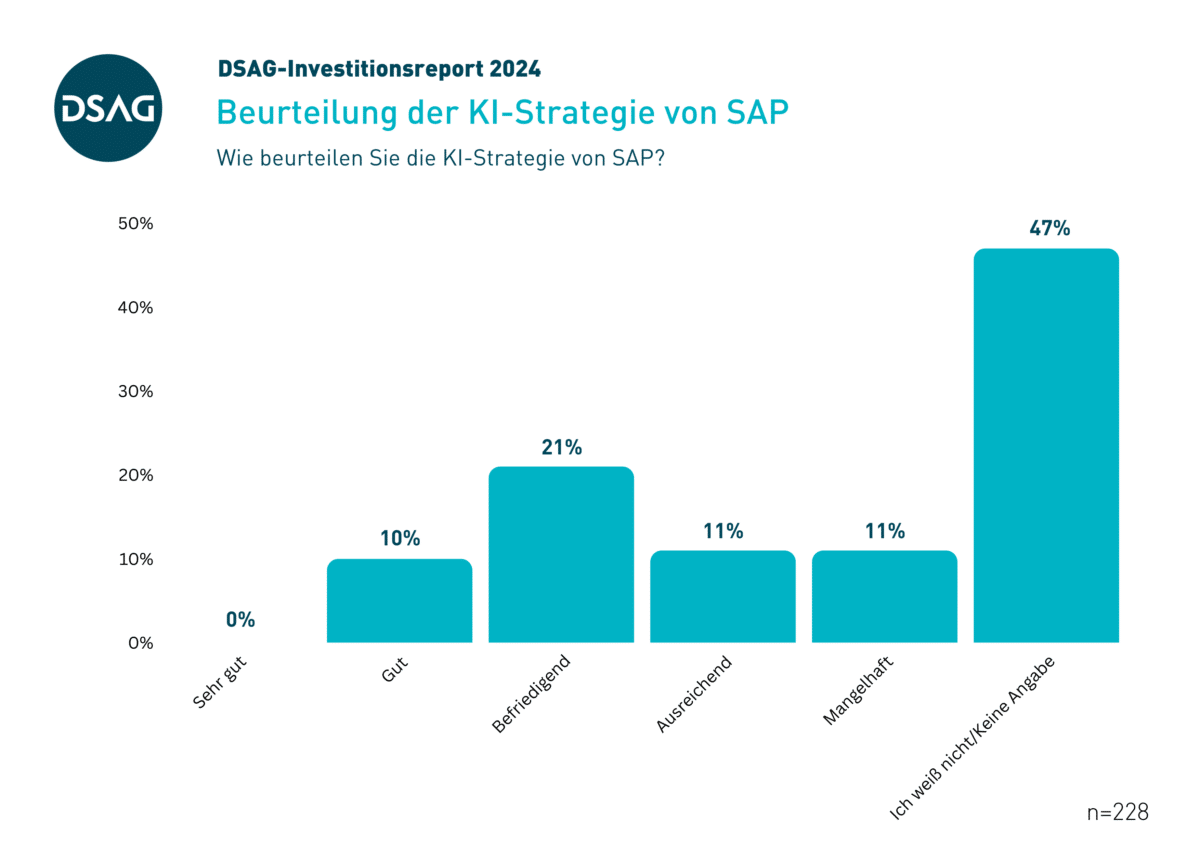

When asked how they rate SAP’s AI strategy, almost half of respondents did not provide any information. 21 percent rated it as satisfactory, while 10 percent rated it as “good”. Specifically, user companies are calling for practical use cases and open integration that also works on-premises.

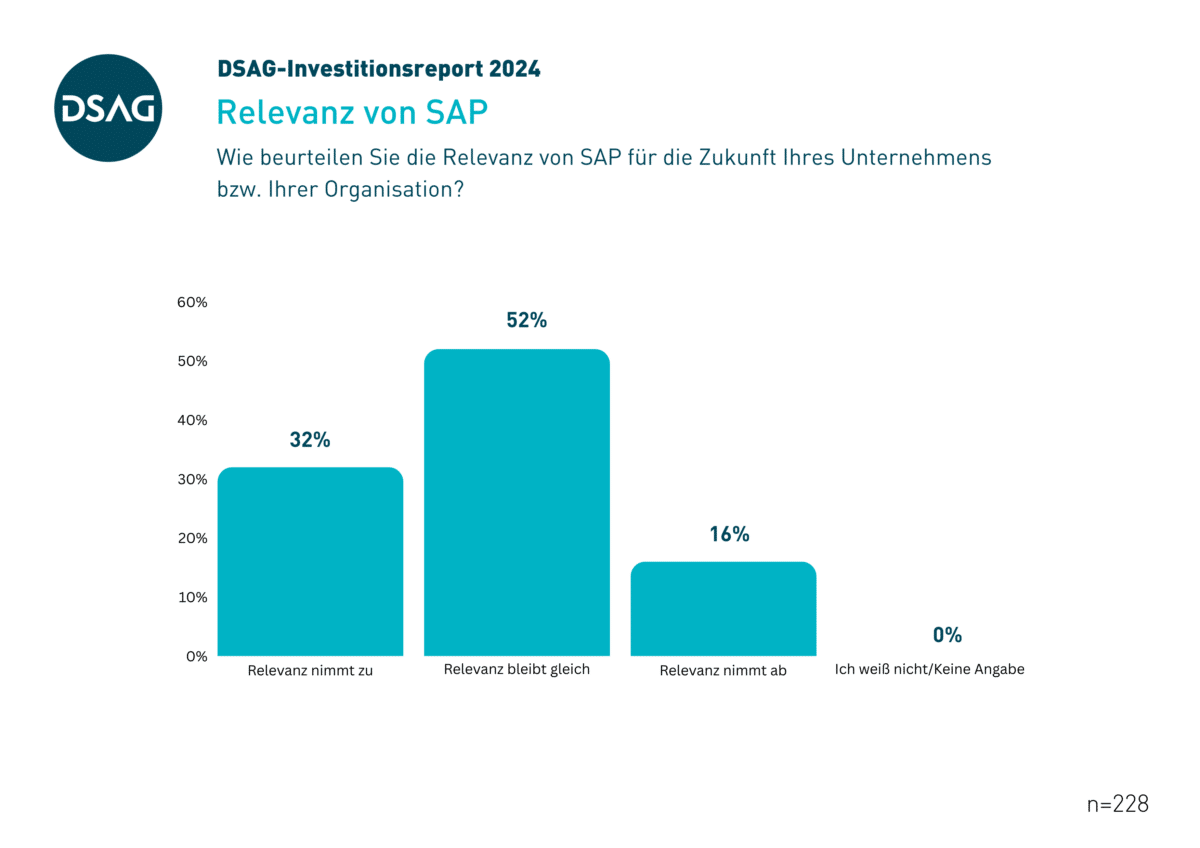

Companies expect SAP to become increasingly relevant

Despite all the criticism of SAP, more than half of those surveyed assume that the relevance of the software manufacturer for the future of their company will remain the same, with 32% even stating that the relevance of SAP is likely to increase. Replacing existing SAP systems is hardly feasible for many organizations in terms of the effort involved (vendor lock).

DSAG still sees significant potential for expansion at SAP in terms of supporting companies with their transformation projects.

About HONICO

HONICO Systems, your expert for Business Workload Automation and License Management (SAM = Software Asset Management) for SAP and other ERP landscapes for over 20 years. Our automation solutions enable centralized, cross-system control and management of your processes, on-prem or in the cloud. This eliminates the need for manual intervention and allows your employees to concentrate on the essentials.

In SAP License Management, we support you with relevant experience in measuring and analysing your SAP authorizations and usage – hybrid and in the cloud. Minimize uncertainties on your path to digitalization, especially when it comes to measuring SAP S/4HANA Cloud. We help you to manage your licenses effectively, reduce software costs and minimize compliance risks.